Market Note 5/31/22

By Lyon Wealth Management on June 1, 2022

Hightower Market Note

Week of May 31, 2022

Stocks Rally on Economic Data. The S&P 500 and Nasdaq Composite indices both broke seven week streaks of declines, while the Dow Jones index broke an eight week streak of declines. Economic news spurred some of the recovery, with revisions to GDP and a core PCE number that provided further support for the “peak inflation” narrative. Positive news also came from Asia, where policy support from the Chinese central bank and steps towards reopening in Shanghai were announced.

Q1 GDP was revised downward to -1.5% from -1.4%, yet we remain positive on some of the underlying components. The consumer, which represents a majority of the economy, spent an upwardly revised +3.1%, driven by a shift to services that was up 4.8%. Consumer demand remains hot, with pent-up demand for services, especially entering the summer months, supported by higher wages and elevated savings. Lower exports and higher levels of inventory were the detractors from Q1 GDP, and as we have previously discussed, they are volatile measures and do not concern us.

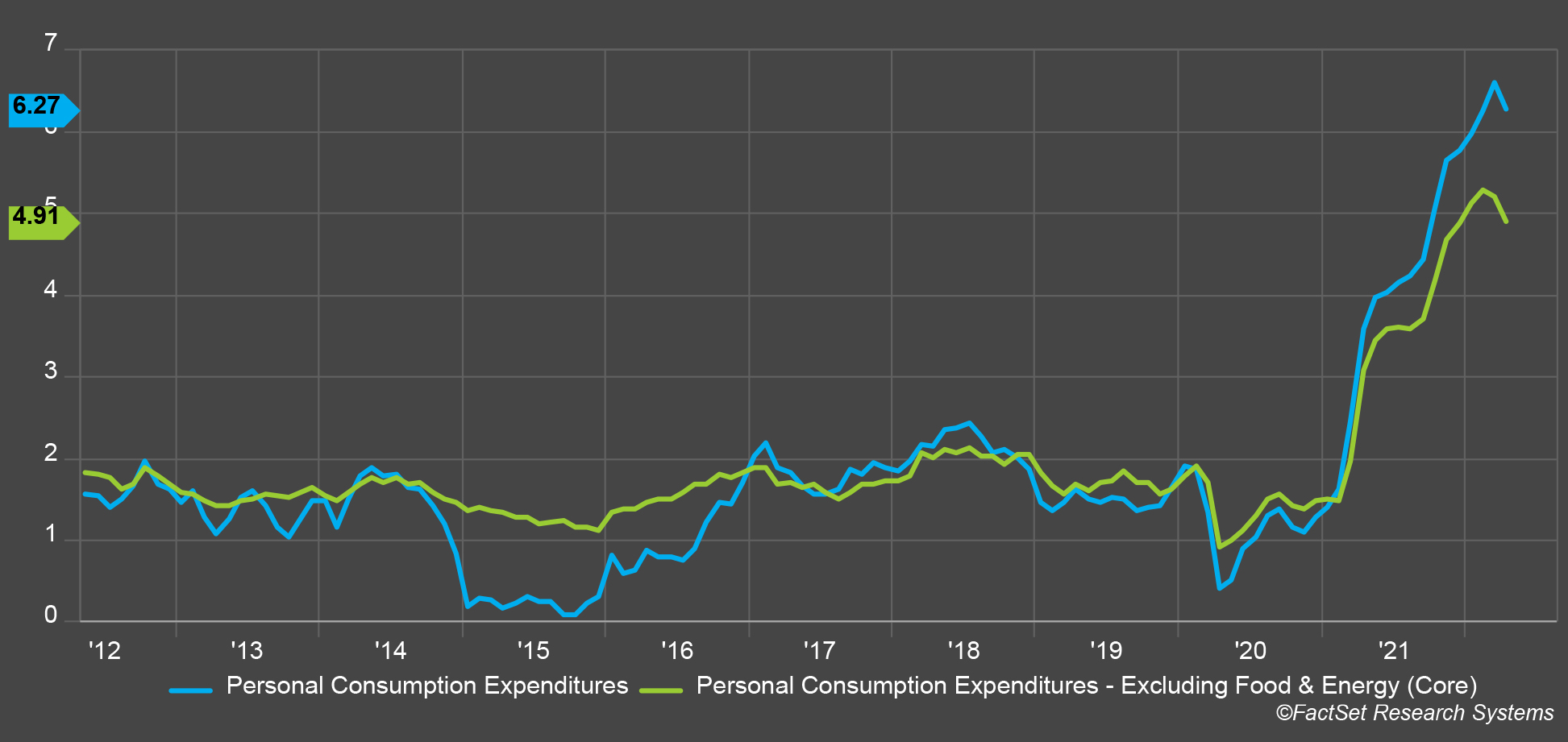

Personal Consumption Expenditures (PCE) rose 6.3% y/y in April, a reduction from 6.6% y/y in March. The Core PCE figure, which is adjusted to remove food and energy, rose 4.9% y/y compared to 5.2% y/y in March. These lower figures, while still elevated, support the idea of peak inflation being reached in March. Factors that contribute to lower inflation include improving supply chains and elevated 2021 base rates.

The Case-Schiller Home Price Index rose 21.2% y/y, serving as a counterpoint to the peak inflation narriative. Seventeen of the 20 cities reported higher price increases in the year ending March 2022. Investors that believed there would be a deceleration in U.S. home prices will have to wait longer for that possibility.

Chart 1: PCE and Core PCE – Rolling Over?

Themes We’re Watching: Retail, Financials, Long Duration, Energy, Housing. Retailers participated in last week’s rally, following commentary on sustained consumer demand, revised GDP data and several companies that were able to manage rising costs. There is an emerging divergence among retailers, and we are watching which management teams can execute and which retailers can adapt to shifting consumer demand. A growing concern among certain retailers has been overordering inventory and not properly adjusting for a consumer shift from “stay-at-home” entertainment to “going out” items, like beauty and luxury, as well as trade-down products where consumers are bargain hunting.

Financials and long duration assets, including tech and discretionary, had big rallies last week, and we’re looking for evidence of whether these rallies can be sustained. An increasing number of technology companies have announced hiring slowdowns, hiring pauses or layoffs.

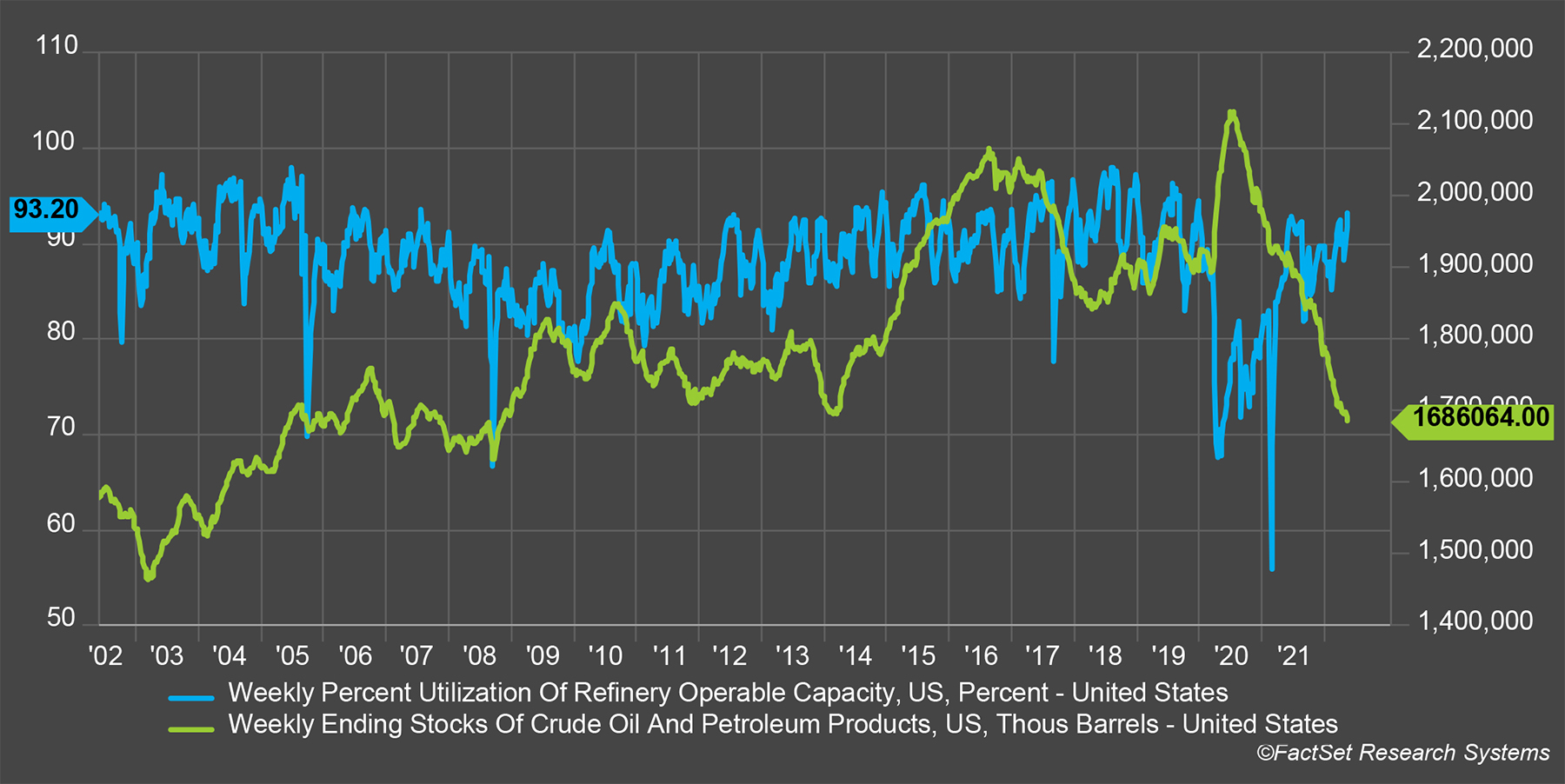

The long energy cycle continues with strength as governments vocally support hydrocarbon investing. The White House has inquired about restarting oil refineries that had previously been shut down. More capacity could increase the volume and efficiency of oil being refined into end-products, but refineries take years to build and operate, and can be expensive to bring back on line or build. The U.K. shared similar aspirations for greater investment in oil and gas, with Prime Minister Boris Johnson stating that the U.K. “can’t turn our backs entirely” on hydrocarbons. Energy stockpiles have declined throughout March, while refining utilization has increased, contributing to another rise in Brent Crude prices, up 11% in May. Energy now represents 4.85% of the S&P 500, up from 2.2% a year ago.

Chart 2: Crude Stockpiles Declining Despite Higher Operating Utilization

Housing markets contracted in April as mortgage rates peaked around 5.25% and have since fallen back near 5.10%. New home sales in April fell 16.6% m/m, well below consensus. Housing tends to be a leading indicator for overall consumer spending and demand.

Bonds Rally on Confirmation of Fed Plan. The Fed minutes released last week indicate plans to hike 50, 50, and 25 bps, respectively, at the next three meetings. Front-loading rate hikes appears to be favored given the risk of a slowing economy in 2023. Following the clear guidance given by the Fed minutes, Treasuries rallied, visible in the 10-year yield finishing the week 12 bps lower at 2.74%. Municipals made major moves last week, falling 30-40 bps across the entirety of the curve. Corporate spreads broadly tightened for the first time in a month, high yield spreads by 64 bps and investment grade by 14 bps.

The Week Ahead.

Econ – Tuesday: S&P/Case-Shiller Housing Price Index (March), Consumer Confidence (May). Wednesday: ISM Manufacturing (May), JOLTS (April). Friday: Nonfarm Payrolls (May), Unemployment Rate (May), ISM Non-Manufacturing (May).

Earnings Calls – Monday: CRM. Tuesday: HPQ, HPE.

Returns for Selected Indices 1

1Source: Bloomberg

Subscribe to Our Newsletter!

Lyon Wealth Management is a group comprised of investment professionals registered with Hightower Advisors, LLC, an SEC registered investment adviser. Some investment professionals may also be registered with Hightower Securities, LLC (member FINRA and SIPC). Advisory services are offered through Hightower Advisors, LLC. Securities are offered through Hightower Securities, LLC.

This is not an offer to buy or sell securities, nor should anything contained herein be construed as a recommendation or advice of any kind. Consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. No investment process is free of risk, and there is no guarantee that any investment process or investment opportunities will be profitable or suitable for all investors. Past performance is neither indicative nor a guarantee of future results. You cannot invest directly in an index.

These materials were created for informational purposes only; the opinions and positions stated are those of the author(s) and are not necessarily the official opinion or position of Hightower Advisors, LLC or its affiliates (“Hightower”). Any examples used are for illustrative purposes only and based on generic assumptions. All data or other information referenced is from sources believed to be reliable but not independently verified. Information provided is as of the date referenced and is subject to change without notice. Hightower assumes no liability for any action made or taken in reliance on or relating in any way to this information. Hightower makes no representations or warranties, express or implied, as to the accuracy or completeness of the information, for statements or errors or omissions, or results obtained from the use of this information. References to any person, organization, or the inclusion of external hyperlinks does not constitute endorsement (or guarantee of accuracy or safety) by Hightower of any such person, organization or linked website or the information, products or services contained therein.

Click here for definitions of and disclosures specific to commonly used terms.

1550 Tiburon Blvd

Suite B Up #6

Tiburon, CA 94920

(415) 702-1622

Legal & Privacy

Web Accessibility Policy

Form Client Relationship Summary ("Form CRS") is a brief summary of the brokerage and advisor services we offer.

HTA Client Relationship Summary

HTS Client Relationship Summary

Hightower Advisors, LLC is a SEC registered investment adviser. Registration as an investment adviser does not imply a certain level of skill or training. Some investment professionals may also be registered with Hightower Securities, LLC and offer securities through Hightower Securities, LLC, member FINRA/SIPC. You can check the background of our firm and investment professionals on brokercheck.finra.org. Unless otherwise indicated relative to a specific award or ranking, Hightower Advisors, LLC does not pay a fee to be considered for any ranking or recognition, but may have paid to publicize rankings obtained and disseminated prior to 11.4.2022. All awards / rankings / ratings obtained and distributed on or after 11.4.2022 will be accompanied by specific disclosure as applicable.

© 2025 Hightower Advisors. All Rights Reserved.