A Decade of Divestment: the Oil and Gas Industry… but First, the Fed Hikes 75 bps

By Lyon Wealth Management on June 16, 2022

The Fed Hikes 75 bps, Higher than Previously Communicated

The Fed announced that it is raising the Fed funds rate 75 bps and will continue to move “expeditiously” to moderate demand and bring down inflation. This is the first hike of this magnitude since 1994 and brings the Fed funds rate to a range of 1.50-1.75%. The Fed increased their year-end expectation to a 3.4% Fed funds rate.

In the prior FOMC meeting, in April, Fed Chair Powell had communicated that they were discussing sequential 50 bps hikes in June and August, but the Fed leaked in recent days the potential for 75 bps, which became the case. The Fed has raised rates by 150 bps year-to-date while communicating further tightening to come, and yields have risen sharply in response:

Year-to-Date Changes in Yields

U.S. 10-year Treasury Yield: +197 bps

Bloomberg U.S. Aggregate Index YTM: +238 bps

U.S. 2-year Treasury Yield: +270 bps

Bloomberg Global High Yield Index YTM: +365 bps

The Fed’s continued tightening and high velocity of rate hikes comes in response to sustained, elevated levels of inflation that remain at or near peak. PPI is +10.8% y/y, CPI is +8.6% y/y, PCE is 6.3% and Core PCE (excl. food and energy) is +4.9% y/y. The Fed is being data-dependent and looking at forward projections that show increasing inflation expectations. By raising rates, the Fed expects headline inflation to drop to 2.6% by the end of 2023 and 2.2% by 2024.

The Fed cut their outlook for 2022 GDP growth from 2.8% in March to 1.7%, and they expect GDP growth to remain below 2% through 2024. Other assumptions from the Fed today are that they expect in 2023 that the unemployment rate will rise to 3.9% (still quite low) and the Fed funds rate to increase to 3.8%. Core inflation of 2.7% seems a stretch to us for 2023 given the elevated levels today. We’ve said for some time that the Fed tightening cycle will help slow growth and some parts of inflation. Food, energy, wages and shelter will be more difficult to contain.

Energy Woes: the Short-Cycle and the Long-Cycle

Today’s high energy prices are a consequence of global supply and capacity. Why is that capacity constrained, and why can’t we bring more oil into market quickly? The answer lies in the tug-of-war between “short cycle” investments for more immediate-term oil production and “long cycle” investments in natural gas and renewable energy sources.

The total number of active oil and gas-producing rigs in the U.S. is 64% below its post-financial crisis peak in 2011. Significant divestment occurred throughout 2015 after a period of oversupply in 2014 that caused a steep oil price drop. The oversupply was largely generated by U.S. advancement in horizontal drilling technology and hydraulic fracturing (fracking) across onshore shale oilfields, along with slowing global economic growth in 2015-2016. The number of active U.S. rigs declined nearly 80% from October 2014 – May 2016.

Today’s environment is driven by the economic re-opening demand and limited capacity to build supply due to anti-fossil fuel incentives. In the current, high-cost environment, it’s unattractive to invest in expensive “short-cycle” projects that produce near-term supply but low long-term ROI with potentially stale assets given the uncertain future for fossil fuels. In addition, capacity at refineries, which turn raw energy materials into useable products, is extremely tight.

Chart 1: Active Rigs Remain Significantly Below Prior Levels, Oil Prices Rising1

Energy prices are a result of supply and demand. During the global COVID pandemic, lockdowns and travel restrictions depleted demand, which resulted in sharply declining oil prices and, soon after, sharply declining production. Since that decline, oil prices have risen because of the robust re-opening demand and a slower rebound in production. At the same time, sanctions against Russia have resulted in depleted Russian volumes, with production falling by approximately 1 million barrels per day since the start of the war – a number that may grow further given proposed sanctions that could embargo 90% of Russian oil supply by year-end.2

The obvious question then becomes: Why doesn’t the oil and gas industry increase production at a faster rate?

Three factors are primarily responsible for why production is slow to pick back up. First, oil companies are enjoying higher profits and are being rewarded for returning capital to shareholders, improving balance sheets and sustainably growing their businesses by investing in “long-cycle” projects like biofuels, natural gas, carbon capture technology and other forms of clean energy (e.g., hydrogen). Second, there is a global lack of capacity to produce because of industry divestment throughout the past decade-plus. And third, the geopolitical environment has been very unstable – led by the Russia/Ukraine war and China policies.

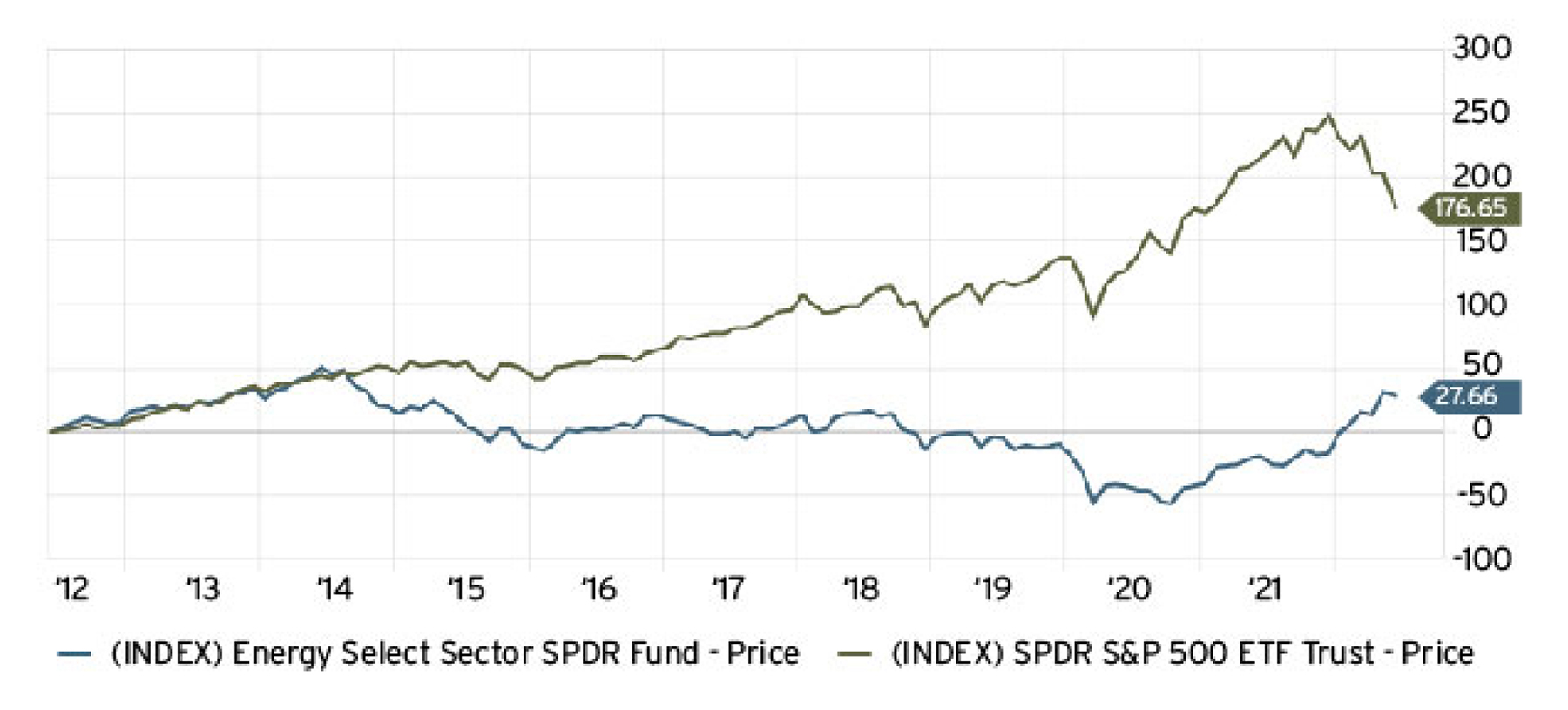

Following a Decade of Underperformance, the Energy Industry is Taking Profits

The energy industry, because of divestments and a supply-driven environment for the past decade, has underperformed the broader market. In June 2014, energy comprised 10.7% of the S&P 500. At the end of 2021, it represented just 2.7% and now, after returning 51.8% YTD, represents 5.1% of the S&P 500.

Chart 2: Energy Sector Has Underperformed Broader S&P 500 Since 2014 3

Following past underperformance and investors beginning to avoid fossil fuels, energy companies are rewarding long-term investors with windfall profits and executing capex discipline to maintain high margins. Record profits are being used to reduce debt and return capital to shareholders via dividends and share buybacks.

It’s important to remember too, that energy resources like oil and natural gas are finite. Increasing short-cycle production is not a sustainable solution in the Permian basin and other energy-dense regions because of the risk that, at a certain point, the assets run dry. Instead, many companies are investing in long-cycle energy transition projects with greater opportunities for long-run returns. Lower quality assets are also being sold as oil and gas companies focus on improving asset quality in this sellers’ market and adjusting their portfolios to be more focused on the long-cycle.

Capacity Shortfalls

Underinvestment in fossil fuels for the better part of the past decade has resulted in an industry with significant capacity constraints globally. OPEC+, which includes 13 members and 10 additional oil-producing nations that, in total, are responsible for roughly 50% of the global oil production, has been gradually increasing production since January 2021. OPEC+ made headlines after agreeing on June 2nd to increase their monthly production by 50%, to 648,000 barrels per day (bpd) in July and August, despite falling consistently short of existing targets.4

According to Amin Nasser, the CEO of Saudi Aramco, the largest oil producer in the world, “the world is running with less than 2% of spare capacity.”5 An expected re-opening in China and international travel will contribute further to the high demand.

Oilfield service-providers are in high demand. Diamondback Energy (FANG) described the service market as a “zero sum game” where there is not enough capacity from service-providers to meet total demand and providers are being selective in accepting projects from customers. Offshore, in addition to service-constraints, many of the necessary oil rigs have been scrapped over the past decade – costing millions of dollars and requiring years to bring back into service.

Refinery capacity utilization is also at its upper limits, impacted by facility closures during the pandemic and weather-related incidents like the Texas freeze in 2021. These facilities are expensive to construct and can take years to build and bring back online. The U.S. Energy Information Administration (EIA) expects refinery utilization to remain at its upper limits throughout the summer.

Chart 3: Rising Production and Capacity Utilization, Supply Still Trending Downward6

Macro Environment Piles on to Existing Supply Problems

As noted above, even before the Russia/Ukraine conflict, there was a significant supply/demand imbalance. Following Russia’s invasion into Ukraine, global sanctions on Russian energy exacerbated the imbalance. This has led the U.S. to negotiate with other historical adversaries, including Venezuela and Iran, about bringing their oil to global markets.

Global reliance on Russia for oil and gas, particularly reliance from Europe, has intensified the need for countries to become energy independent. Natural gas is poised to play a significant role in both the transition to lower carbon and energy independence.

Energy Sector: Where Will It Go From Here?

Within the S&P 500, energy has outperformed the next best-performing sector by 62% YTD. Despite this record run of performance, forward price-to-earnings (NTM P/E) valuation multiples are 3% below where they started the year, 43% below where they were one year ago and 35% below the current S&P 500 weighted average NTM P/E. While prices have risen substantially, so have earnings. Balance sheets are also healthier, with higher quality assets and growing shareholder-return programs.

With valuations remaining broadly attractive and amid record cash flows, the current cycle is likely to continue favoring companies with efficient cash flow generation and capex discipline. The long-cycle is likely to favor companies that are well-positioned for an energy transition with a sustainable portfolio of differentiated and high-quality assets. We expect that the continued supply/demand imbalances, high price realizations and attractive valuations are likely to continue carrying broad momentum across the sector into 2023.

Please reach out to us if you have any questions or schedule an appointment.

Todd Lyon, CIMA®, AIF®

Lyon Wealth Management

tlyon@hightoweradvisors.com

Visit Our Website

Disclosures

Investment Solutions at Hightower Advisors is a team of investment professionals registered with Hightower Securities, LLC, member FINRA/SIPC, & Hightower Advisors, LLC a registered investment advisor with the SEC. All securities are offered through Hightower Securities, LLC and advisory services are offered through Hightower Advisors, LLC. This is not an offer to buy or sell securities. No investment process is free of risk and there is no guarantee that the investment process described herein will be profitable. Investors may lose all of their investments. Past performance is not indicative of current or future performance and is not a guarantee. In preparing these materials, we have relied upon and assumed without independent verification, the accuracy and completeness of all information available from public and internal sources; as such, neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Hightower shall not in any way be liable for claims and make no expressed or implied representations or warranties as to their accuracy or completeness or for statements or errors contained in or omissions from them. This document was created for informational purposes only; the opinions expressed are solely those of the author, and do not represent those of Hightower Advisors, LLC or any of its affiliates.

Securities offered through Hightower Securities, LLC member FINRA/SIPC. Hightower Advisors, LLC is a SEC registered investment advisor. This document was created for informational purposes only; the opinions expressed are solely those of the author, and do not represent those of Hightower Advisors, LLC or any of its affiliates.

Subscribe to Our Newsletter!

Lyon Wealth Management is a group comprised of investment professionals registered with Hightower Advisors, LLC, an SEC registered investment adviser. Some investment professionals may also be registered with Hightower Securities, LLC (member FINRA and SIPC). Advisory services are offered through Hightower Advisors, LLC. Securities are offered through Hightower Securities, LLC.

This is not an offer to buy or sell securities, nor should anything contained herein be construed as a recommendation or advice of any kind. Consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. No investment process is free of risk, and there is no guarantee that any investment process or investment opportunities will be profitable or suitable for all investors. Past performance is neither indicative nor a guarantee of future results. You cannot invest directly in an index.

These materials were created for informational purposes only; the opinions and positions stated are those of the author(s) and are not necessarily the official opinion or position of Hightower Advisors, LLC or its affiliates (“Hightower”). Any examples used are for illustrative purposes only and based on generic assumptions. All data or other information referenced is from sources believed to be reliable but not independently verified. Information provided is as of the date referenced and is subject to change without notice. Hightower assumes no liability for any action made or taken in reliance on or relating in any way to this information. Hightower makes no representations or warranties, express or implied, as to the accuracy or completeness of the information, for statements or errors or omissions, or results obtained from the use of this information. References to any person, organization, or the inclusion of external hyperlinks does not constitute endorsement (or guarantee of accuracy or safety) by Hightower of any such person, organization or linked website or the information, products or services contained therein.

Click here for definitions of and disclosures specific to commonly used terms.

1550 Tiburon Blvd

Suite B Up #6

Tiburon, CA 94920

(415) 702-1622

Legal & Privacy

Web Accessibility Policy

Form Client Relationship Summary ("Form CRS") is a brief summary of the brokerage and advisor services we offer.

HTA Client Relationship Summary

HTS Client Relationship Summary

Hightower Advisors, LLC is a SEC registered investment adviser. Registration as an investment adviser does not imply a certain level of skill or training. Some investment professionals may also be registered with Hightower Securities, LLC and offer securities through Hightower Securities, LLC, member FINRA/SIPC. You can check the background of our firm and investment professionals on brokercheck.finra.org. Unless otherwise indicated relative to a specific award or ranking, Hightower Advisors, LLC does not pay a fee to be considered for any ranking or recognition, but may have paid to publicize rankings obtained and disseminated prior to 11.4.2022. All awards / rankings / ratings obtained and distributed on or after 11.4.2022 will be accompanied by specific disclosure as applicable.

© 2025 Hightower Advisors. All Rights Reserved.