Avoiding the Noise and Paying Attention to What’s Really Moving the Markets

By Lyon Wealth Management on April 27, 2022

The two worst performing sectors year-to-date in the S&P 500 index are information technology and communication services, both down more than 20%. Combined, these sectors make up 36% of the index. By comparison, energy, the only positive sector year-to-date, makes up just 4% of the index.

The media loves discussing Elon Musk buying Twitter (TWTR) and celebrities boycotting Spotify ( SPOT), but context is important: The former only makes up 0.1% of the index, and SPOT is not even in the index. We prefer to focus on what really matters for investors’ money, keeping in mind that the S&P 500 represents a large equity position for most investors – either through a passive fund, an ETF or benchmark for an actively managed portfolio.

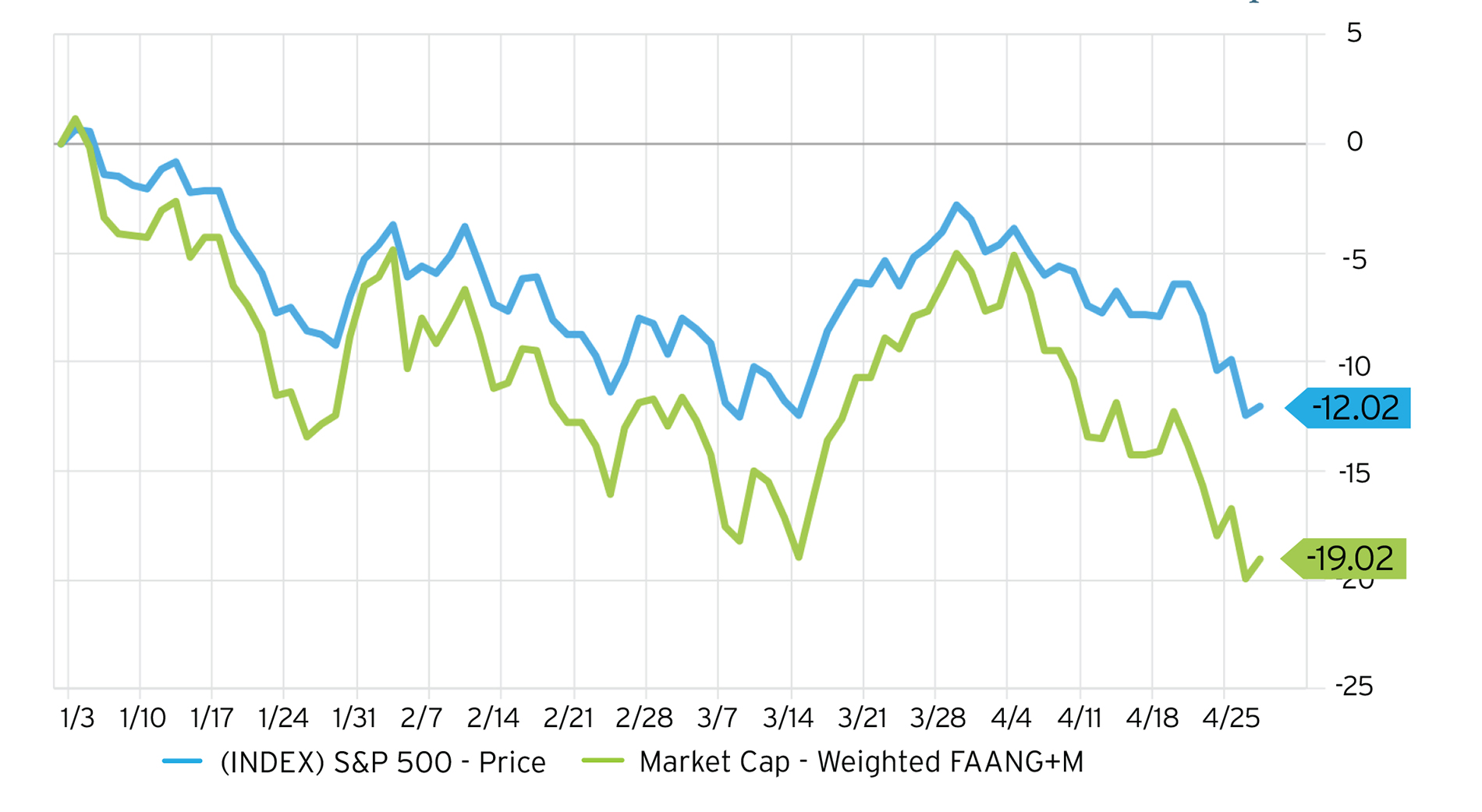

The FAANG+M stocks – Facebook, Amazon, Apple, Netflix, Google and Microsoft – have historically generated momentum and contributed outperformance for the index; this year, the opposite has been true. Facing new headwinds, expensive valuations, rising rates and uncertain forward growth, FAANG +M, as a growth lever, may have had its time in the sun. Owning impactful pieces of the pie, not the whole thing, and scrutinizing valuation is the strategy for which we are advocating.

Information Technology and Communication Services: Quality Names May Offer Opportunity

Technology is the largest group in the S&P 500 by a wide margin, representing nearly 27% of the index. Among the S&P 500’s information technology and communication services names, nearly 75% have a higher price-to-earnings (P/E) multiple than the index’s weighted average. As interest rates rise, valuation contraction takes form for many securities – and often more drastically for high-multiple growth names, explaining, at least in part, the tech sector’s underperformance year-to-date. Lower quality, non-earners can also experience a severe pullback in the current market environment.

In contrast, high quality growth stocks with profits and pricing power can become attractive in an economic slowdown. We look at management strength, profits, balance sheets and, of course, valuation within high quality growth.

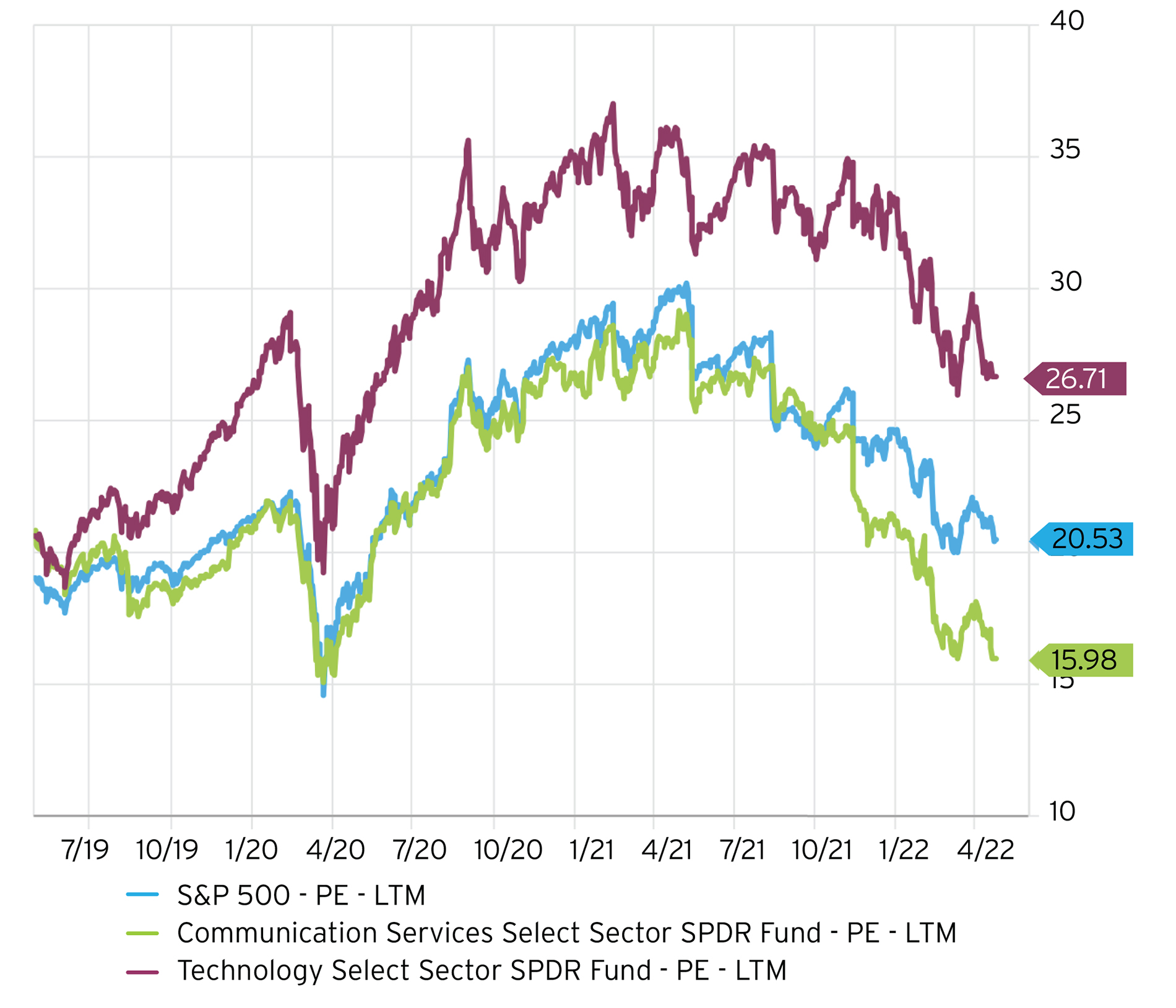

Valuations have pulled back measurably in technology and communications. The S&P 500 communication services sector has a P/E valuation multiple of 16x its last 12 months (LTM) aggregate earnings, compared to 28x just one year ago. The S&P 500 information technology sector has an LTM P/E of 27x, compared to 36x just one year ago. In contrast, the total index has a current LTM P/E multiple of 21x. Conditions indicate that multiples are at historically low levels for the communication services sector and moderate levels, comparable to pre-pandemic, for information technology.

When valuation multiples, like P/E, contract, investors can find buying opportunities in names that are mispriced. Overall, we believe this to be a stock-pickers’ market, with some names that maintain strong business models being caught in the broader group downdraft… and we believe those names can outperform if bought at the right price.

Chart 1: LTM P/E Multiple Contraction1

FAANG+M: Driving the Market Up… and Down

Meta (FB), Apple (AAPL), Amazon (AMZN), Netflix (NFLX), Alphabet (GOOGL) and Microsoft (MSFT) make up nearly 25% of the S&P 500 and have contributed to more than half of its year-to-date decline. Apple and Microsoft make up nearly half of the S&P 500 information technology sector. Meta and Alphabet are nearly a third of the S&P 500 communication services sector. And Amazon makes up nearly a quarter of the S&P 500 consumer discretionary sector. Their significant weightings make them important stocks to follow.

Recently these names have contributed to large swings and volatility. Netflix dropped more than 35% after their earnings last week. Meta dropped more than 25% after their earnings last quarter. The size of these moves is atypical for such mega-cap stocks and points to uneasiness in markets and unfamiliarity for these names to periods of hardship. Netflix has never in the past decade been faced with falling subscriptions, and Meta is facing stalled user growth and ad revenue headwinds.

These names are familiar to the average consumer because most, if not all, play a role in our daily lives. Investors have historically considered these names to be mega-cap growth, and performance has shown that to be true. Prior to this year, annualized return for each of these names over the past 15 years has been >25%, compared to the S&P 500’s return of 16.8%. Apple is the only name outperforming the index year-to-date. As these companies navigate new business strategies, it has yet to be seen whether they can keep up with that historic growth. Whether that happens or not, it’s unlikely to remain the same core group of mega-cap outperformers forever.

So far, for Q1 earnings, Netflix, Alphabet and Microsoft have reported. Microsoft reported a slight beat, while Alphabet and Netflix both missed. Meta reports Wednesday (4/27), and Amazon and Apple report Thursday (4/28). They’re all looking to prove markets are wrong and that growth is still ahead, though, so far, headwinds and slowdowns have captured the narrative.

Chart 2: Year-to-Date Performance of S&P 500 and FAANG+M Stock Group2

Eye on the Prize

In volatile markets like the one in which we currently sit, it’s easy to lose sight of the long-term… and we maintain our conviction in a quality approach. Downdrafts are difficult to weather, and it’s important for investors to ensure that discipline, not emotion, drives investing decisions. Moreover, we like it when high quality names are “on sale,” and we continue to look for opportunities that develop.

Please reach out to us if you have any questions or schedule an appointment.

Disclosures

Investment Solutions at Hightower Advisors is a team of investment professionals registered with Hightower Securities, LLC, member FINRA/SIPC, & Hightower Advisors, LLC a registered investment advisor with the SEC. All securities are offered through Hightower Securities, LLC and advisory services are offered through Hightower Advisors, LLC. This is not an offer to buy or sell securities. No investment process is free of risk and there is no guarantee that the investment process described herein will be profitable. Investors may lose all of their investments. Past performance is not indicative of current or future performance and is not a guarantee. In preparing these materials, we have relied upon and assumed without independent verification, the accuracy and completeness of all information available from public and internal sources; as such, neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Hightower shall not in any way be liable for claims and make no expressed or implied representations or warranties as to their accuracy or completeness or for statements or errors contained in or omissions from them. This document was created for informational purposes only; the opinions expressed are solely those of the author, and do not represent those of Hightower Advisors, LLC or any of its affiliates.

Securities offered through Hightower Securities, LLC member FINRA/SIPC. Hightower Advisors, LLC is a SEC registered investment advisor. This document was created for informational purposes only; the opinions expressed are solely those of the author, and do not represent those of Hightower Advisors, LLC or any of its affiliates.

1Source: FactSet (chart)

2Source: FactSet (chart)

Subscribe to Our Newsletter!

Lyon Wealth Management is a group comprised of investment professionals registered with Hightower Advisors, LLC, an SEC registered investment adviser. Some investment professionals may also be registered with Hightower Securities, LLC (member FINRA and SIPC). Advisory services are offered through Hightower Advisors, LLC. Securities are offered through Hightower Securities, LLC.

This is not an offer to buy or sell securities, nor should anything contained herein be construed as a recommendation or advice of any kind. Consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. No investment process is free of risk, and there is no guarantee that any investment process or investment opportunities will be profitable or suitable for all investors. Past performance is neither indicative nor a guarantee of future results. You cannot invest directly in an index.

These materials were created for informational purposes only; the opinions and positions stated are those of the author(s) and are not necessarily the official opinion or position of Hightower Advisors, LLC or its affiliates (“Hightower”). Any examples used are for illustrative purposes only and based on generic assumptions. All data or other information referenced is from sources believed to be reliable but not independently verified. Information provided is as of the date referenced and is subject to change without notice. Hightower assumes no liability for any action made or taken in reliance on or relating in any way to this information. Hightower makes no representations or warranties, express or implied, as to the accuracy or completeness of the information, for statements or errors or omissions, or results obtained from the use of this information. References to any person, organization, or the inclusion of external hyperlinks does not constitute endorsement (or guarantee of accuracy or safety) by Hightower of any such person, organization or linked website or the information, products or services contained therein.

Click here for definitions of and disclosures specific to commonly used terms.

1550 Tiburon Blvd

Suite B Up #6

Tiburon, CA 94920

(415) 702-1622

Legal & Privacy

Web Accessibility Policy

Form Client Relationship Summary ("Form CRS") is a brief summary of the brokerage and advisor services we offer.

HTA Client Relationship Summary

HTS Client Relationship Summary

Hightower Advisors, LLC is a SEC registered investment adviser. Registration as an investment adviser does not imply a certain level of skill or training. Some investment professionals may also be registered with Hightower Securities, LLC and offer securities through Hightower Securities, LLC, member FINRA/SIPC. You can check the background of our firm and investment professionals on brokercheck.finra.org. Unless otherwise indicated relative to a specific award or ranking, Hightower Advisors, LLC does not pay a fee to be considered for any ranking or recognition, but may have paid to publicize rankings obtained and disseminated prior to 11.4.2022. All awards / rankings / ratings obtained and distributed on or after 11.4.2022 will be accompanied by specific disclosure as applicable.

© 2025 Hightower Advisors. All Rights Reserved.