The Service Economy

By Kayla Campos on July 23, 2021

With much of last week’s focus around CPI numbers, we wanted to take a closer look at the services component of the index. CPI “measures the change in prices paid by consumers for goods and services.”1 While both goods and services are impacted by shifts in supply/demand, goods are tangible, while services are intangible. If you go to a market and purchase ground beef, you’re paying for the good, which is largely driven by the price of beef. If you have a hamburger delivered to your home for dinner, you’re paying a significant amount more for the service than you are the actual good. The service economy is more complex with regard to the factors that impact price for the end consumer. What drives costs of college tuition or getting your vehicle repaired or your phone bill? It’s not as simple as the price of a commodity.

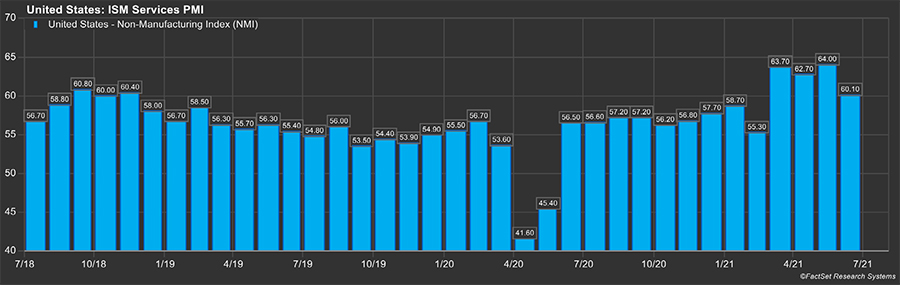

The United States hosts the largest service economy in the world, with services accounting for an estimated 80% of U.S. GDP.2 The Institute for Supply Management (ISM) produces a monthly index which provides insight into the general state of business in the service sector. A reading above 50 indicates an expanding service economy. June ISM numbers indicated a growing service economy (for the 13th straight month), although growth slowed from a record May. Of the 18 service sectors tracked, 16 saw gains in June. As we anticipate the next report date from ISM on August 2nd, we will be watching supply/demand shifts, materials shortages, logistical challenges, extreme weather and employee shortages.3

Many of the logistical challenges have been well documented in the news and are exacerbated by materials shortages, which impact output and inventories. Extreme weather continues to create disruptions for utilities and insurance services, among others. Employee shortages are causing challenges for companies that cut employees during the pandemic, like hospitality and transportation, and are now trying to service a surge in re-opening demand. These factors not only impact company bottom-lines, but also longer-term pricing that’s passed on to the consumer.

United States: ISM Services PMI4

|

| In Federal Reserve chair Jerome Powell’s latest testimony, he reiterated that the Fed will not change policy until the labor market has further strengthened.5 Many of the jobs projected to be filled are in services industries experiencing labor shortage. The latest Job Openings and Labor Turnover Survey (JOLTS) shows that the highest increase in job openings for May was in the leisure and hospitality industry (+19.5%), while hiring has slowed for the same industry.6 This trend is also realized for a handful of other services industries in the report, signifying that companies may need to increase wages (if they have not yet done so) to attract workers and fill employee shortages.Another services metric we continue to monitor is the Shelter Index, specifically Rent of Shelter, which showed 0.5% MoM growth in the latest CPI report for June.7 Foreclosure moratoriums have contributed significantly to the rise in shelter costs. According to the Biden-Harris Administration, July will be the final month of extending foreclosure moratoriums; we will be watching the impact thereafter. |

Rent of Shelter vs. Wages and Salaries8

|

The Service Economy Goes DigitalNot all services are created equal. The pandemic sparked a significant need for digital services as consumers were unable to visit physical locations. We saw the rise of e-commerce, telehealth, and digital payments. This “Digital Revolution,” as it’s been called, did not start with the pandemic. In fact, it’s been in motion for a few years and has made distinction between goods and services more difficult. Home gym equipment (good) is now equipped with a workout subscription (service). Smart TVs (goods) now include a streaming package (service). During the pandemic, companies that were best equipped to adapt to a digital services model seemed to win against those that could not. It’s near impossible to make transportation, theme parks, or hotels digital. While retail, health care, and financial services certainly felt the effects of the pandemic, their business models allowed them to innovate towards a growing digital demand more easily. These shifts in business models will continue to take shape and advance even with a re-opened economy. |

Conclusion: We are Watching for Stickier InflationWhile the Fed broadly continues its dovish stance, we are a little more skeptical. The dominance of the service economy to US GDP and the historical “stickiness” of wage and shelter costs lead us to believe we may see inflation sooner rather than later. |

Please reach out to us if you have any questions or comments. |

1 Source: U.S. Bureau of Labor Statistics

2 Source: cia.gov, The World Factbook

3 Source: ISM – Institute for Supply Management

4 Source: FactSet

5 Source: CNBC

6 Source: U.S. Bureau of Labor Statistics

7 Source: U.S. Bureau of Labor Statistics

8 Source: FactSet

Subscribe to Our Newsletter!

Lyon Wealth Management is a group comprised of investment professionals registered with Hightower Advisors, LLC, an SEC registered investment adviser. Some investment professionals may also be registered with Hightower Securities, LLC (member FINRA and SIPC). Advisory services are offered through Hightower Advisors, LLC. Securities are offered through Hightower Securities, LLC.

This is not an offer to buy or sell securities, nor should anything contained herein be construed as a recommendation or advice of any kind. Consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. No investment process is free of risk, and there is no guarantee that any investment process or investment opportunities will be profitable or suitable for all investors. Past performance is neither indicative nor a guarantee of future results. You cannot invest directly in an index.

These materials were created for informational purposes only; the opinions and positions stated are those of the author(s) and are not necessarily the official opinion or position of Hightower Advisors, LLC or its affiliates (“Hightower”). Any examples used are for illustrative purposes only and based on generic assumptions. All data or other information referenced is from sources believed to be reliable but not independently verified. Information provided is as of the date referenced and is subject to change without notice. Hightower assumes no liability for any action made or taken in reliance on or relating in any way to this information. Hightower makes no representations or warranties, express or implied, as to the accuracy or completeness of the information, for statements or errors or omissions, or results obtained from the use of this information. References to any person, organization, or the inclusion of external hyperlinks does not constitute endorsement (or guarantee of accuracy or safety) by Hightower of any such person, organization or linked website or the information, products or services contained therein.

Click here for definitions of and disclosures specific to commonly used terms.

1550 Tiburon Blvd

Suite B Up #6

Tiburon, CA 94920

(415) 702-1622

Legal & Privacy

Web Accessibility Policy

Form Client Relationship Summary ("Form CRS") is a brief summary of the brokerage and advisor services we offer.

HTA Client Relationship Summary

HTS Client Relationship Summary

Hightower Advisors, LLC is a SEC registered investment adviser. Registration as an investment adviser does not imply a certain level of skill or training. Some investment professionals may also be registered with Hightower Securities, LLC and offer securities through Hightower Securities, LLC, member FINRA/SIPC. You can check the background of our firm and investment professionals on brokercheck.finra.org. Unless otherwise indicated relative to a specific award or ranking, Hightower Advisors, LLC does not pay a fee to be considered for any ranking or recognition, but may have paid to publicize rankings obtained and disseminated prior to 11.4.2022. All awards / rankings / ratings obtained and distributed on or after 11.4.2022 will be accompanied by specific disclosure as applicable.

© 2025 Hightower Advisors. All Rights Reserved.