Where To Look in Uncertain Times

By Lyon Wealth Management on May 25, 2022

Quality on Sale

In a time of uncertainty, even companies with strong fundamentals are susceptible to headwinds, which is what we are seeing today. Many quality names have gotten swept into the sell-off due to issues such as labor shortages, supply chain bottlenecks, geopolitical risks, high inflation and the Fed’s plan to raise interest rates.

While such downdrafts can be painful, we choose to view them as an opportunity to add to companies that fit our “Quality on Sale” theme – companies that have strong balance sheets and can produce cash flow at a consistent rate, that are trading at attractive prices. These types of companies are in a position to reward shareholders with a return of capital from the business.

Buybacks or Dividends, Who Is the Real King?

Companies return capital to their shareholders by issuing dividends and implementing share repurchase programs. Companies that are in a position to do both are viewed as more resilient places to put capital.

Both buybacks and dividends can boost shareholder returns. But which is the better option?

A dividend payment represents a definite return, which is subject to tax if the stock is held in a taxable account. A buyback represents an uncertain return in the future that is tax-deferred until the position is sold. When companies buy back stock, it reduces the number of outstanding shares, which can drive the share price higher.

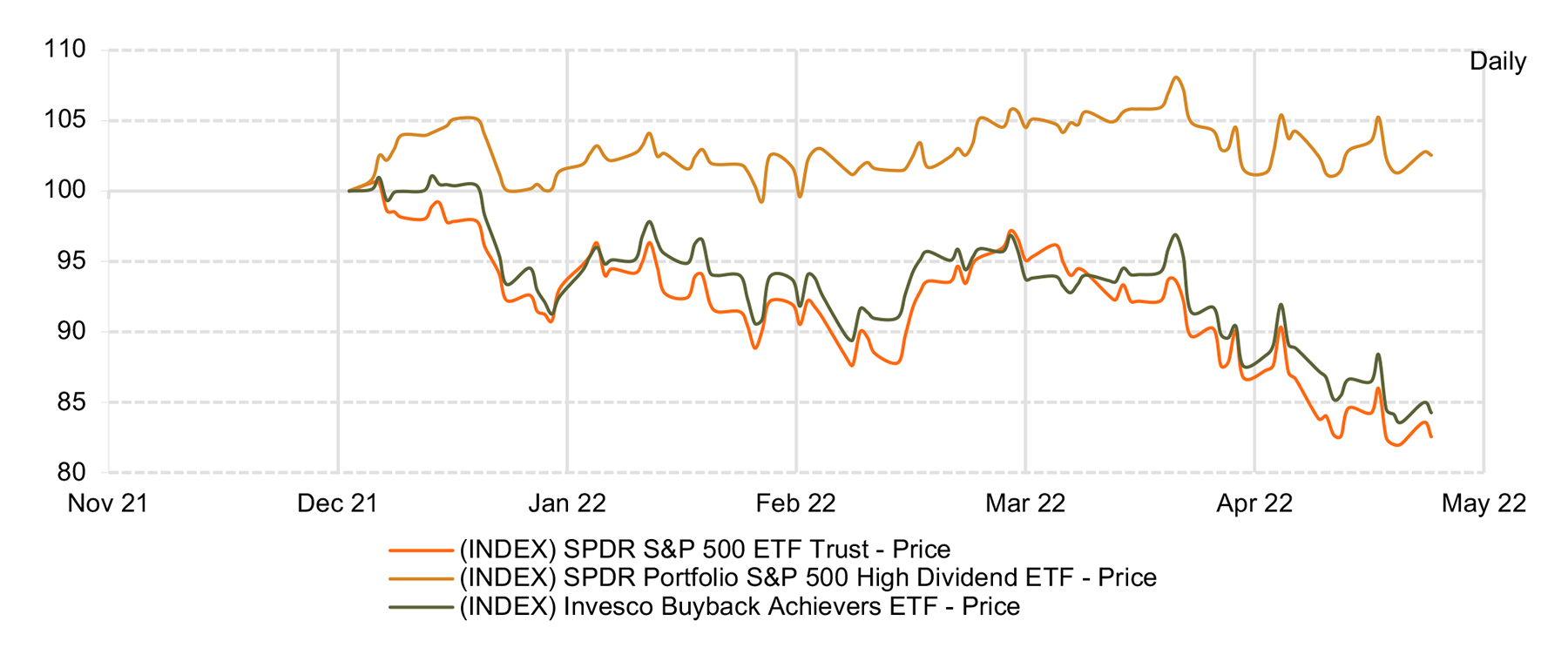

Chart 1: YTD S&P 500 vs S&P High Dividend ETF vs Invesco Buyback Achievers1

Chart 1 suggests that investors reward dividend payers more than they do companies that repurchase shares. This makes intuitive sense – a finite amount of cash in hand today is usually superior to the potential promise of cash sometime in the future – especially in these challenging times. Firms with higher dividend payouts have outperformed those with lower payments by 3-4% annually over the past 20+ years (BofAresearch). High buyback stocks have generally underperformed over the last 3 years; this is most evident when looking into technology stocks.

The chart shows this divergence since January 1st; high dividend stocks maintained their gains while the S&P and Invesco buyback ETF traded lower. The S&P High Dividend ETF remains up 3.52% YTD, proving that strong dividend stocks can outperform in today’s market.

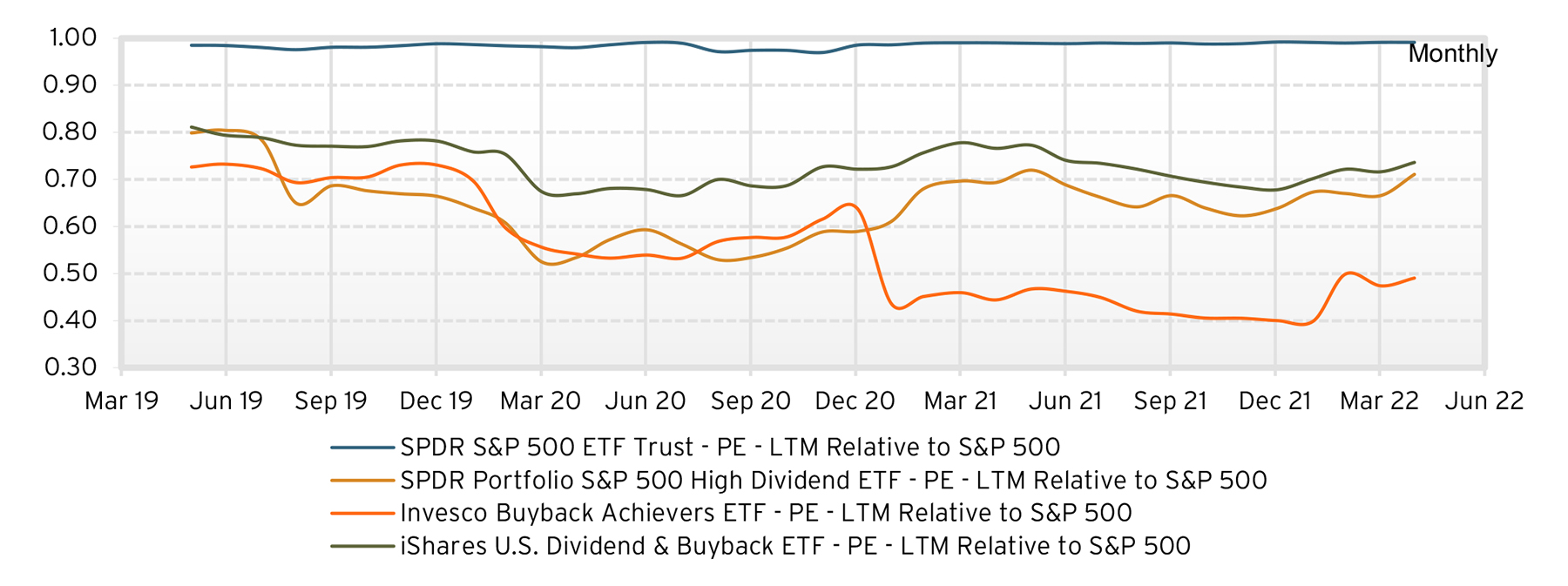

Chart 2, below, demonstrates that companies that are able to return capital to shareholders through both dividends and buybacks have shown more strength on a price to earnings ratio than the latter.

Chart 2: S&P High Dividend ETF, Invesco Buyback Achievers ETF, iShares U.S. Dividend & Buyback ETF vs SPY PE LTM2

There is a theme emerging that high dividend and buyback stocks are diverging in performance, as seen on chart 1.

The trends outlined here offer clues as to why some big tech names have been hit so hard. Most tech companies are growth names, often trading on Price/Sales rather than Price/Earnings, and often paying little or no dividend to shareholders. This helps explain why QQQ is down over (27.57%) YTD, while SPY is down (16.95%).

That said, there are plenty of examples of strong technology companies that were caught up with the lower quality names that have been selling off this year. This provides many opportunities for investors to buy these companies as their mulitples compress. So, while we favor dividend payers and buybacks in this market, we continue to look for solid names that can be added to our portfolio through a barbell and top down approach.

Please reach out to us if you have any questions or schedule an appointment.

Disclosures

Investment Solutions at Hightower Advisors is a team of investment professionals registered with Hightower Securities, LLC, member FINRA/SIPC, & Hightower Advisors, LLC a registered investment advisor with the SEC. All securities are offered through Hightower Securities, LLC and advisory services are offered through Hightower Advisors, LLC. This is not an offer to buy or sell securities. No investment process is free of risk and there is no guarantee that the investment process described herein will be profitable. Investors may lose all of their investments. Past performance is not indicative of current or future performance and is not a guarantee. In preparing these materials, we have relied upon and assumed without independent verification, the accuracy and completeness of all information available from public and internal sources; as such, neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Hightower shall not in any way be liable for claims and make no expressed or implied representations or warranties as to their accuracy or completeness or for statements or errors contained in or omissions from them. This document was created for informational purposes only; the opinions expressed are solely those of the author, and do not represent those of Hightower Advisors, LLC or any of its affiliates.

Securities offered through Hightower Securities, LLC member FINRA/SIPC. Hightower Advisors, LLC is a SEC registered investment advisor. This document was created for informational purposes only; the opinions expressed are solely those of the author, and do not represent those of Hightower Advisors, LLC or any of its affiliates.

1Source: FactSet (chart)

2Source: FactSet (chart)

Subscribe to Our Newsletter!

Lyon Wealth Management is a group comprised of investment professionals registered with Hightower Advisors, LLC, an SEC registered investment adviser. Some investment professionals may also be registered with Hightower Securities, LLC (member FINRA and SIPC). Advisory services are offered through Hightower Advisors, LLC. Securities are offered through Hightower Securities, LLC.

This is not an offer to buy or sell securities, nor should anything contained herein be construed as a recommendation or advice of any kind. Consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. No investment process is free of risk, and there is no guarantee that any investment process or investment opportunities will be profitable or suitable for all investors. Past performance is neither indicative nor a guarantee of future results. You cannot invest directly in an index.

These materials were created for informational purposes only; the opinions and positions stated are those of the author(s) and are not necessarily the official opinion or position of Hightower Advisors, LLC or its affiliates (“Hightower”). Any examples used are for illustrative purposes only and based on generic assumptions. All data or other information referenced is from sources believed to be reliable but not independently verified. Information provided is as of the date referenced and is subject to change without notice. Hightower assumes no liability for any action made or taken in reliance on or relating in any way to this information. Hightower makes no representations or warranties, express or implied, as to the accuracy or completeness of the information, for statements or errors or omissions, or results obtained from the use of this information. References to any person, organization, or the inclusion of external hyperlinks does not constitute endorsement (or guarantee of accuracy or safety) by Hightower of any such person, organization or linked website or the information, products or services contained therein.

Click here for definitions of and disclosures specific to commonly used terms.

1550 Tiburon Blvd

Suite B Up #6

Tiburon, CA 94920

(415) 702-1622

Legal & Privacy

Web Accessibility Policy

Form Client Relationship Summary ("Form CRS") is a brief summary of the brokerage and advisor services we offer.

HTA Client Relationship Summary

HTS Client Relationship Summary

Hightower Advisors, LLC is a SEC registered investment adviser. Registration as an investment adviser does not imply a certain level of skill or training. Some investment professionals may also be registered with Hightower Securities, LLC and offer securities through Hightower Securities, LLC, member FINRA/SIPC. You can check the background of our firm and investment professionals on brokercheck.finra.org. Unless otherwise indicated relative to a specific award or ranking, Hightower Advisors, LLC does not pay a fee to be considered for any ranking or recognition, but may have paid to publicize rankings obtained and disseminated prior to 11.4.2022. All awards / rankings / ratings obtained and distributed on or after 11.4.2022 will be accompanied by specific disclosure as applicable.

© 2025 Hightower Advisors. All Rights Reserved.